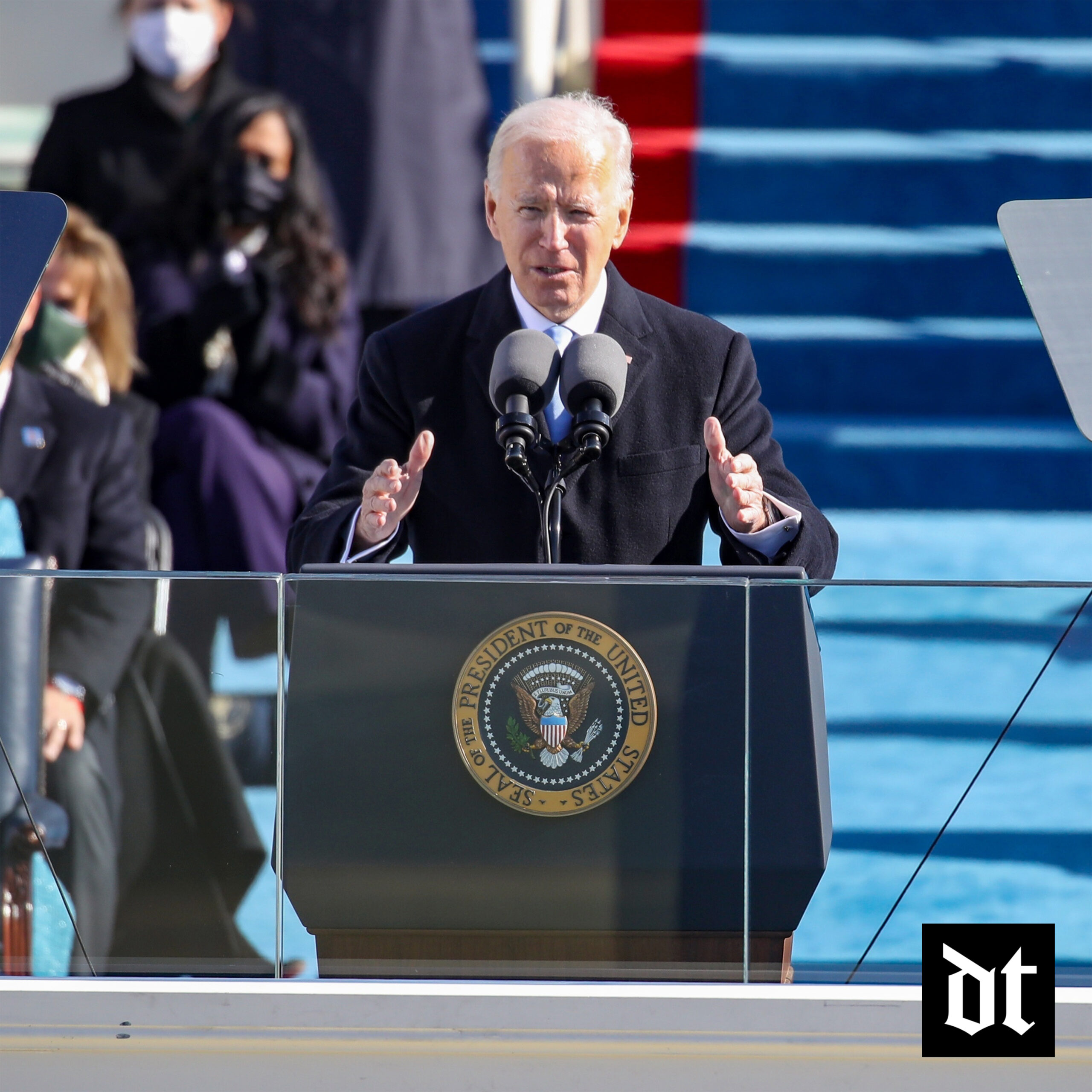

When Biden announced his plan to take off some burden of student loans early last week, borrowers were elated. The program, which is expected to begin the next few months, will offer financial relief of $20,000 in federal student loans for borrowers and an additional $10,000 to those eligible to Pell Grant recipients, is going to help more than 63 million people, some of whom are drowning in student debt.

The decision by Biden and his administration has sparked different reactions from people. Some are in support, and others are against the relief plan and its effect on the economy; more so, inflation which has been almost at its highest rate in the last four decades. Some people have deemed it unfair to point out that this financial burden that the federal government is taking on will be directed to the taxpayers.

The Sizzling Debt Debate

Among economists, a heated debate has sparked on how the debt forgiveness plan will affect the country. While progressives see this break as a chance for borrowers to direct their spending on things that could improve their living standards and the country’s economy, skeptical economists are not sold on the plan. Because of its effect on current inflation, some believe this debt cancellation will only increase prices.

According to the wealth effect, having less debt encourages consumer spending. Therefore, in theory, debt forgiveness will give borrowers more purchasing power, increasing their spending. In the current economic climate, where businesses work overtime to keep up with consumer demand, debt forgiveness will only dampen the Federal Reserve’s effort to control prices. The Committee for a Responsible Budget (CRFB) estimated a $10,000 debt cancellation could make up to 0. 15% inflation rate for those earning under $300,000.

Organizations like The Center for American Progress pointed out that while we can expect inflation changes, the impact will be minimal. Unlike last year’s $20,000 stimulus relief, the forgiveness program recipients receive relief from loan payment which has minimal sway on consumer spending. Chief economist Mark Zandi mentioned that the estimate provided on the inflation rate is only temporary. Beginning next year, borrowers will start getting payment reminders as the freeze ends.

Solution Or Band-Aid To The Problem?

Some have argued that while the debt plan relief will offer borrowers forgiveness, it is only a band-aid masking the real problem. With college tuition expenses still on the high end, this move by Biden will only encourage students to take more loans with the hope of future forgiveness. On another end, this plan gives college institutions the power to increase pricing by raising tuition, which only worsens the high college costs. What is your take on the historical Biden debt forgiveness plan? Is the forgiveness program the first step in the right direction to help borrowers struggling with student debt? Or could Biden’s student loan relief not be worth taking a chance in the current economic climate?